Public Adjuster VS. Attorneys

Before one can comprehend the various disparities between a public adjuster and a lawyer, one must understand the job functions that are performed by a public adjuster and how they help their clients in ways that an attorney may not be able to. When an individual is faced with property loss or property damage due to several reasons such as natural disasters, and even structural damage of their property, they might spend an enormous part of their time arguing with them insurance companies to be compensated for all the losses that they sustained, and that could be quite frustrating. At the end of the day, insurance companies do not want to pay them customers the maximum amount that they deserve for their losses; they try to avoid it at all cost; that is where a public adjuster steps in.

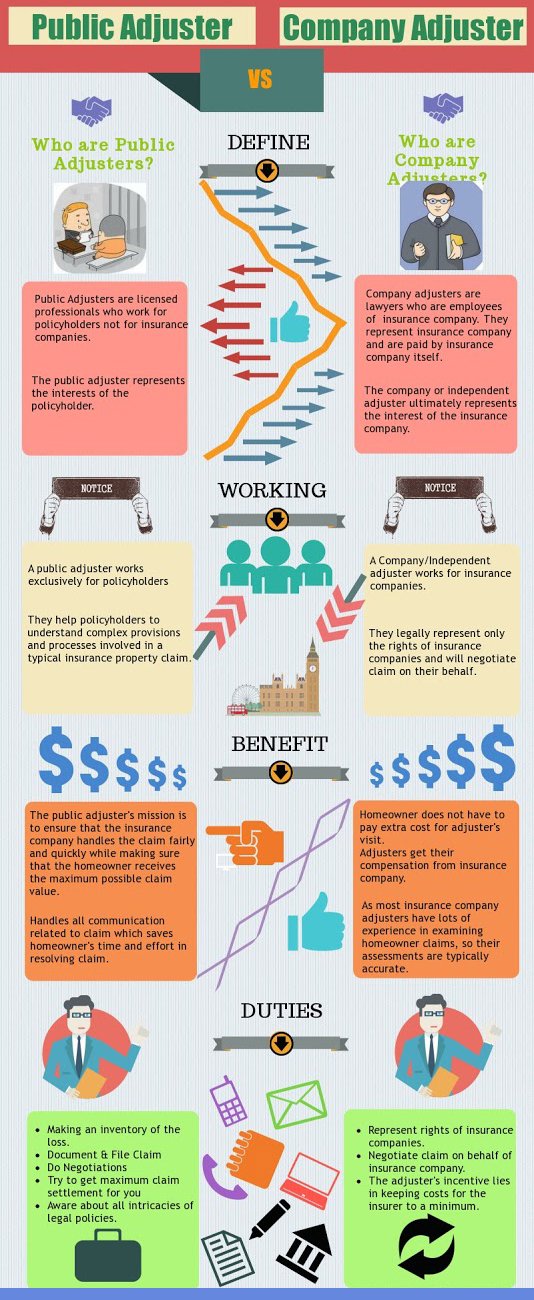

Public Adjusters VS. Company Insurance Adjusters

A public adjuster is an expert with insurance policies; they are professionals who do not work for the insurance companies, they work for the policyholders. They know the language and details related to insurance policies and are quite knowledgeable in the field of construction and other related areas. They evaluate the property loss of their clients by using software that is specially made for their clients benefit by estimating the correct amount of property loss for the policyholder, logging initial and additional claims, and submitting them on behalf of the policyholder. In addition, public adjusters not only help businesses or individuals file a claim, but they also assist these individuals when their own insurance companies do not offer them the adequate amount of compensation for their damages. In other words, they fight for their client’s rights and are their voice against these lousy insurance companies that will stop at nothing to give their policyholders the least amount of money possible.

Why Choose a Public Adjuster?

Many individuals may be wondering to themselves: “why should I choose a public adjuster if I have my attorney?” Well, while to most it is a simple answer, others may not fully comprehend the scope enticed by these two professionals. If a victim of property damage or loss would want to attain the compensation that they deserve, then they are going to want to contact a skilled public adjuster. Unlike an attorney, a public adjuster does not steer from cases that involve detailed administrative work, of which property loss/damage cases are known to be. Only when an insurance company no longer acts in good faith or a wrongful denial is present will a lawyer take on a property damage case. An attorney will not decide to take on a property damage claim only because a low amount of compensation was offered by the company or due to the payment fee structure.To make things short, an attorney will only step in when they see it as an advantage for themselves, not when the policyholder needs them the most as a public adjuster would. Below are some key points of a public adjuster vs. an attorney:

- A public adjuster will perform the case with the same or better results as would a lawyer for less money

- No fees are incurred unless the settlement has been won; nothing is paid-out-of-pocket

- No hourly rate is charged in addition to the percentage of the settlement

- All the “dirty work” will be done for their clients due to their extensive knowledge of the matter that they hold

These above vital points are just some of the many disparities that a public adjuster and an attorney are composed of in their line of work. The best bet that someone who has endured property loss has would be to speak with a public adjuster who is ready to take the claim to the end. Just remember, a public adjuster is not an insurance companies friend, they represent their client.

What Can be Done for Their Clients?

A public adjuster can provide various services to their clients. They work hard to fulfill their clients’ needs and ensure that their client’s rights have been fought for extensively. Their primary goal is to acquire the compensation that their client merits, primarily through these difficult moments in their life; their client may have just lost everything they worked for: their home, their vehicle, their personal belongings, which is why a compassionate, yet experienced public adjuster will not rest until fairness has been reached. These are some actions and responsibilities that a client could expect to see done by a public adjuster:

- Decoding of the legal jargon linked to the claim that may not be understood by the

- policyholder

- All of the damages incurred are researched and documented to ensure accuracy

- Persistence by the public adjuster to ensure that the claim is pushed to the insurance

- company

- Value of damage sustained is determined by the adjuster

- Estimates of the losses are prepared

- The full extent of damage is made clear to the policyholder

- Negotiation of settlements

- Cases containing discrepancy could be re-opened if the public adjuster sees best

- Expedite the claim

- Achieve maximum settlement

A public adjuster wants what is best for their client. They will use their knowledge, valuable information, experience, and dedication to see the policyholder receive a fair settlement as fast as possible before having to reach litigation. The only time a policyholder should contact an attorney during a property loss claim is if the case has to reach court due to the insurance company not wanting to pay off their policyholder, other than that, a public adjuster will do just as good or even better than an insurance lawyer.

Which Types of Claims Could a Public Adjuster Take On?

Public adjusters are professionals and licensed in the area of property and related matter. They have extensive information on all types of property damages, how the damage was acquired, what can be done to gain the most out of the damages caused, and how they can make their clients lives less stressful. These are the common types of claims that public adjusters take on:

- Explosions

- Smoke and fire

- Damage from hail

- Wind and hurricane damage

- Lighting

- Mold

- Power outage

- Plumbing leaks

- Roof damage

- Hurricane Claims

- Vandalism/theft

- Flood/water damage (the most common type of claim)

- Sinkholes; and

- More

If unsure whether an individual’s damage could be taken on by a public adjuster before resorting to an attorney, do not hesitate in contacting a licensed public adjuster and consulting with them before making a final decision.

Myths That Have Been Linked to Public Adjusters

Every professional is composed of myths, stereotypes, and rumors. That is no different for a public adjuster. These are some myths that have been linked to the public adjuster that may steer someone away from seeking help in contacting a public adjuster vs. a lawyer. Some of those myths include:

- A considerable portion of the compensation is taken by the adjuster, and nothing is done for their clients – – The truth is that there is a cap by every state with the amount of money an adjuster can take and due to the strenuous amount of administrative work, these cases take time to process and require a lot of hard work, research, and time by the public adjuster.

- Public Adjusters are criminals – – The truth is that an extensive background and fingerprinting must be passed by a public adjuster before they can attain their license.

- If a public adjuster is hired, the insurance company will drop the policyholder – The truth is that retaliation by the insurance company cannot occur due to the state code of ethics.

- Insurance fraud is committed by public adjuster – The truth is that insurance companies just agree to pay the amount demanded by the adjuster; they do not commit fraud. At the end of the day, insurance companies are businesses and just want to continue receiving money without having to deal with claims.

- Premiums will go up when a public adjuster is used – The truth is that gauging is not allowed by insurance companies due to the regulation that the state code of ethics provides.

Do Not Fear; the Public Adjusters Are Here!

The information provided above was in the efforts in assisting those who are confused as to whether to elect an attorney or a public adjuster for their property damage claim. It hopes to provide the potential client a great deal of information and sense of understanding that offers them enough evidence that the job will and can be done by a public adjuster. A public adjuster should be chosen to deal with any matter that involves property damage; they know their stuff and do not back down, even when they might not see the light at the end of the tunnel, as an attorney would. Attorneys will only take on a case when they see it suited for them. A public adjuster will help their client from the beginning to the end. Because of the abundant amount of property loss cases handled by professional public adjusters, they understand the economic, along with the sentimental value that property damage can cause an individual. There may be no words that can make the victim of such loss feel better, but the actions taken by a licensed public adjuster in Florida will prove otherwise. Remember, Florida, along with many other states are victims of flood damage on a grand scale. At our office, we can help victims and do strive to attain the most out of each claim.

References:

- https://www.valuepenguin.com/public-insurance-adjusters

- http://www.advocateclaims.com/2012/attorneys-or-public-adjuster-who-should-you-hire-why.html

- http://www.noblepagroup.com/2016/10/23/top-5-myths-public-adjusting-busted/

- http://www.noblepagroup.com/2018/03/01/insurance-claim-problems-hiring-a-public-adjuster-vs-an-attorney/