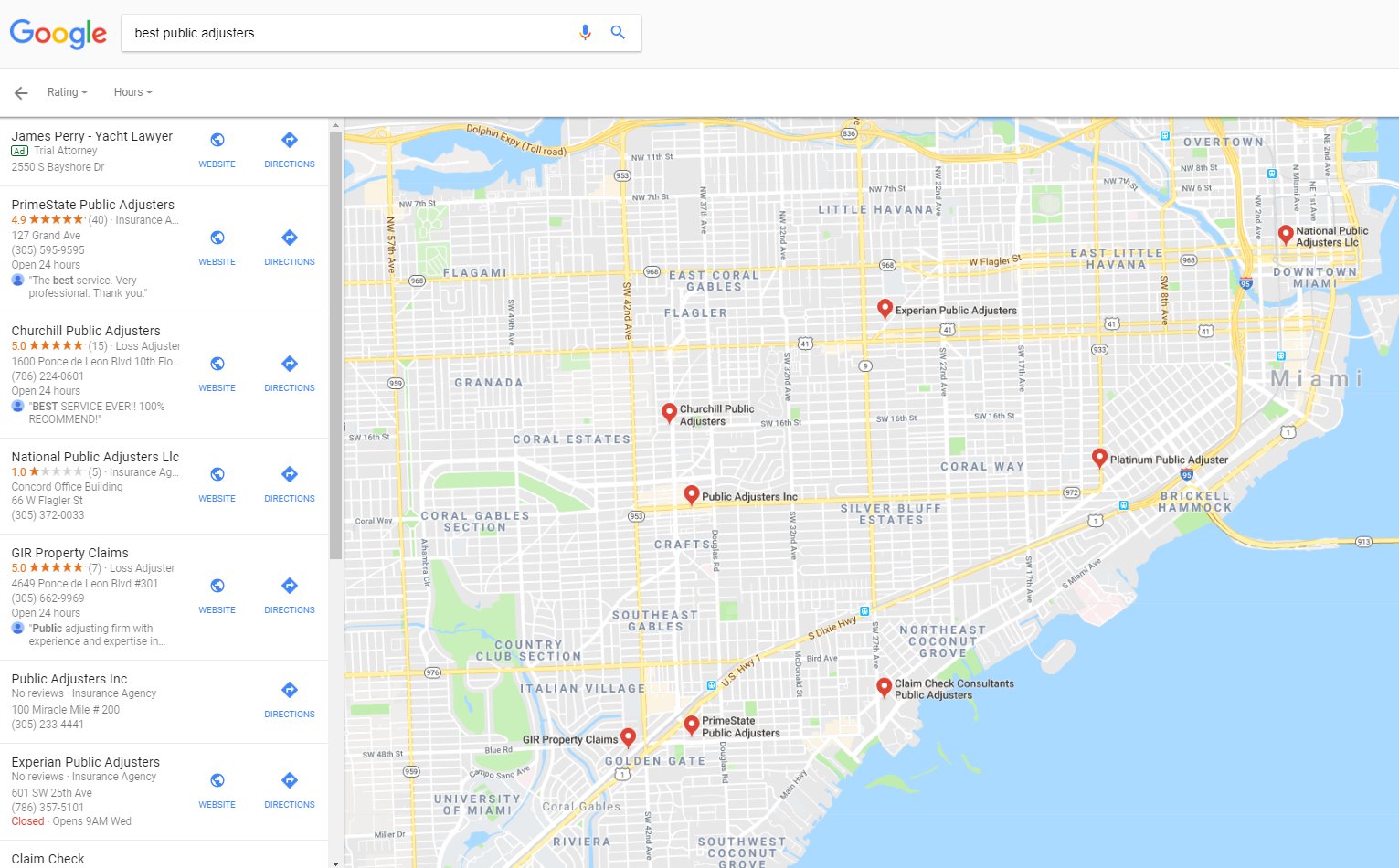

A flood is one of the worst things that can happen to a homeowner. Flood insurance brings some respite as the public adjuster can quickly assess the damages and bring financial relief. These coverage’s are not included in a homeowner’s policy, so it must be separate insurance that is purchased to cover flooding in Miami homes.

The Initial Assessment of Damages of Flooding

When a home or apartment is flooded, the first thing that must be done is too sure there are no safety concerns. Things like down power lines, septic leaks, and other hazards may need cleaning beyond the average person’s scope. Once the area is deemed safe, turn off the water lines. Disconnect all electrical appliances to make sure there is no risk of electrocution. The utility companies must be notified if there are an electric, water, gas or sewage line problems.

Renters do not have to shoulder the responsibility of paying for an insurance policy or claim. The landlord should have adequate coverage. However, the policy usually does not cover the tenants’ personal belongings. A renter’s policy will include them in the event of a burst pipe but not an act of nature.

Get Proof of The Damages

Get lots of photographs before any cleanup begins. All flooded areas must be documented, and this evidence is used to support the insurance claim. The public adjuster will want to see these pictures and other documentation of the incident.

During a flood, the water damage is categorized as clean, gray, or black. Clean water is nothing more than a nuisance, but it does not present any health risks. Gray water comes from sinks, showers, dishwashers, but does not contain fecal matter. Blackwater is the most dangerous as it includes sewage.

Cleaning Up the Mess

Once the damages have been assessed, a decision must be made on whether to clean up the mess or call in professionals. First, open all the windows to help the air circulate. The excess water must be removed, so it does not cause mold and swelling on drywall or floorboards. A shop vac or water pump can quickly remove the mess. Anything that was contaminated with sewage must be thrown away. Carpets and furniture should be cleaned and sanitized if it can be salvaged. Diluted bleach is the best thing to disinfect after a flood.

Be on the lookout for any damaged that were missed during the original assessment. The electric breaker box should be turned off and not turned back on until it has been cleared by a professional. Gas lines should be inspected before used too. When handling water that is contaminated, make sure that you use gloves, masks, and other protective gear.

Things Not Covered with Flood Insurance

Unless flooding happens as the result of a broken pipe or another covered peril, there will not be any coverage of a typical insurance policy. A separate policy is required to ensure the Miami home is adequately covered. There are two types of flood policies one that includes the house and another that covers personal belongings. A standard homeowner’s flood policy covers the structure, electrical, sewage, appliances, carpet, and other structural things. A personal affect insurance coverage is for clothing, furniture, area rugs, window AC units, microwave ovens, and the washer and dryer.

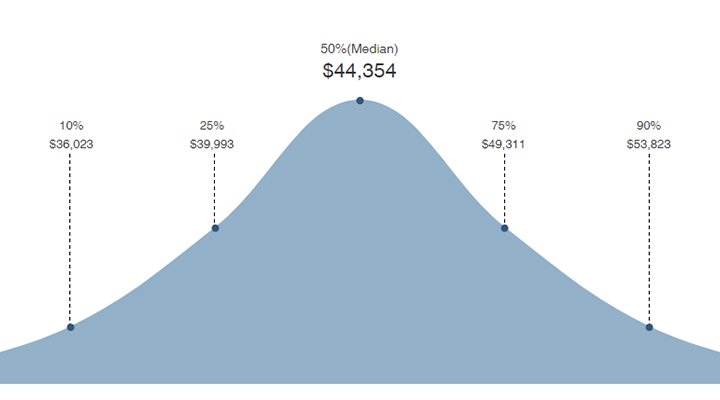

There are also dollar amounts and limits on insurance. It is always best to have adequate coverage to protect all the things that make a house a home. Floods can happen at any time in Florida, and the last thing a person wants is to be caught with water a foot high and have no insurance coverage.