If your home was flooded, it can be difficult to determine whether you should file a claim for flood damage or natural disaster damage. While each of these claims address similar damages, the claims process including how claims are dealt with are different. A flood is a temporary condition in which water or mudflow intrudes two or more acres of your property. Policies for homeowners, renters, and business owners do not cover flood type damages. Flood coverage is purchased through the National Flood Insurance Program. Understanding this can be very confusing and/or frustrating for a homeowner. A public adjuster is advised to assist and support the homeowner in understanding these issues that may arise from such type claims.

Floods are widespread in the United States. Between 2003-2012, there was a total of $4 billion worth of flood insurance claims. Did you ever think that there is a one in four chance of having a flood on your property throughout your mortgage? Your property, has just endured a flood resulting in damage. It was something that just suddenly happened and has left you shocked.

You are devastated and are not able to think clearly. What do you do? Who do you call? Will your insurance company really “help” you? Insurance companies are after one thing: profit. That is their business, and if they pay you the full amount of your damages, they do not profit from it. Here is where you have to contact us; Public Adjusters. We will explain everything associated with flood damages, and we will review your policy to determine if it covers you. Just be aware that the “typical” policy does not cover floods, you usually have to purchase a separate insurance for flood claims.

Root Causes of Floods on Properties

If you reside in an area where flooding occurs you may assume that you can just get federal disaster assistance to cover your damages. Most federal disaster relief is to cover infrastructure damage, and only 15% is released to the homeowners. Typically, the payout that goes to the homeowner is around $4,000 that is usually not nearly enough to cover the damages sustained to your home. If you have a flood insurance policy, the payouts are significant and may pay enough to get your home fixed in severe cases.

With no flood insurance, your options are insufficient. You can hope for a small payout from the federal disaster funds, and you can take out a personal loan or use your savings to repair the damages to your home. Not every homeowner has the capability of taking out a loan, or have the funds on hand to pay to fix it themselves, and even if you receive assistance from the federal government it can take months or longer to receive funding.

The average cost to repair a home that has sustained flood-damage after a minor flood can be up to $12,000 and that can be much higher after a significant flood event in your area. The water damage can quickly turn into a toxic mold which is a significant health hazard and is very costly to eradicate.

Floods can occur at any given moment. They can arise from many different factors. Some of the main reasons why floods happen are the following:

- Hurricanes or tropical storms: These typically bring a lot of water with them and usually end up creating more damages than a storm with high winds.

- Clogged drain pipes: Having a clogged pipe can lead to a flood of your property. The floods can occur inside your home and outside as well.

- New development or construction: Building a new structure or fixing an old one takes effect on the natural drainage, which can create floods.

What our Public Adjusters can do to Help

Flood Insurance companies and their adjusters often take the stand, that the damages on your property is due to storm surge or wind damage and not by flood damages. Churchill Public Adjusters can negotiate your claim through detailed figures of flood damage, using expert methods and weather experts to support your flood claims. Today, every claim that has been denied or underpaid, the clients that we have worked with have received what their fair share amount.

As your personal point of contact, we will make sure you end up with the best possible settlement whether it be consultation, appraisal, mediation or litigation. When unexpected water or flood damages your property, contacting Churchill Public Adjusters will ensure you get your life back on track and in order.

You may be concerned with what steps to take next. You may have filed a claim with your insurance company about the flood damage your property suffered, but it was denied. Whatever the reason, we will provide you with a skilled set of public adjusters. We work with you. Along with achieving maximum fair payment, we empathize with your loss. We understand that it is a current hardship placed in your life, and we want to relieve some of that tension. If you have been a property owner who has encountered flood damages, don’t delay in contacting us. We know how to deal with the insurance companies so you don’t have to.

Public Adjuster Flood Damage Sheet by Serafin Martinez on Scribd

Filing An Insurance Claim For Flood Damage

If you want the process to go smoothly, here are some tips you need to take:

- Call your provider. Give them your name, the number of your policy and an email or telephone you can be reached at in they need more information.

- Document the damage: take pictures of the damages, compile a list of the things you lost in the flood and include the date you purchased them and keep your receipts if you can.

- Provide evidence of the damage: the pictures you took and the receipts you kept will be given to your insurance company which will then look at the damages that were made and make an estimate from there.

Common Reasons For Flood Occurrences

Floods can occur at any given moment. They can arise from many different factors. Some of the main reasons why floods happen are the following:

- Hurricanes or tropical storms: These typically bring a lot of water with them and usually end up creating more damages than a storm with strong winds.

- Clogged drain pipes: Having a clogged pipe can lead to a flood of your property. The floods can occur inside your home and outside as well.

- New development or construction: Building a new structure or fixing an old one takes an effect on the natural drainage, which can create floods.

Case Study

A family’s home was destroyed after Hurricane Sandy hit their New Jersey home in 2012. They filed a claim to their insurance company and their company low balled the flood and wind damage that happened to their home. The company basically gave them less than the worth of the damages. So the family hired a public adjuster on their behalf and got an extra $13,000 for flood damages and an extra $9,000 for wind damage.

FAQ

How much does it cost for you to repair flood damage?

Repairing your home after a flood becomes a lengthy process and it is super pricey especially if you hire a professional. The average cost for flood repairs are:

- It is about $2,700 to dry out a home

- Essentially, your insurance will at most give you $7,500 for the damages, this includes drying and reconstruction

Do Home Insurance Cover Flood Damage?

Home insurance is vital to flood damage, especially in South Florida during hurricane seasons. However, most home insurance do not cover flooding that were caused by extreme weather conditions unless you paid extra for it. Most home insurance don’t even cover backed up sewers, to put it in perspective. The amount of your home insurance depends upon the amount of coverage you would want. A certain policy that covers flood insurance covers all buildings in your property and everything it contains.

What Does Flood Insurance Do For Your Flood Damage?

National Flood Insurance Program is the most common flood insurance you can get. It helps cover your home or building for up to $250,000 in damages and your policy will cover your personal property for up to $100,000. You have the option of buying one or both depending on your preference. Personal belongings such as jewelry, bearer bonds, money, stock certificates, your loss of income, cars, pools, hot tubs, and the like are not covered in this policy.

What Kinds Of Damages Does Flood Damage Do To Your Home?

Flood damages not only affect your home but also your health physically and mentally. Some of the health risks include structural damage, electrical damages and risks, landlines, damaged crops, sharp glasses and metals, contaminated water, and the like. The loss of life to someone close to you is also devastating and puts an emotional strain on your life. Flood damages can also do property damage and economic loss.

What Happens After A Flood Damage?

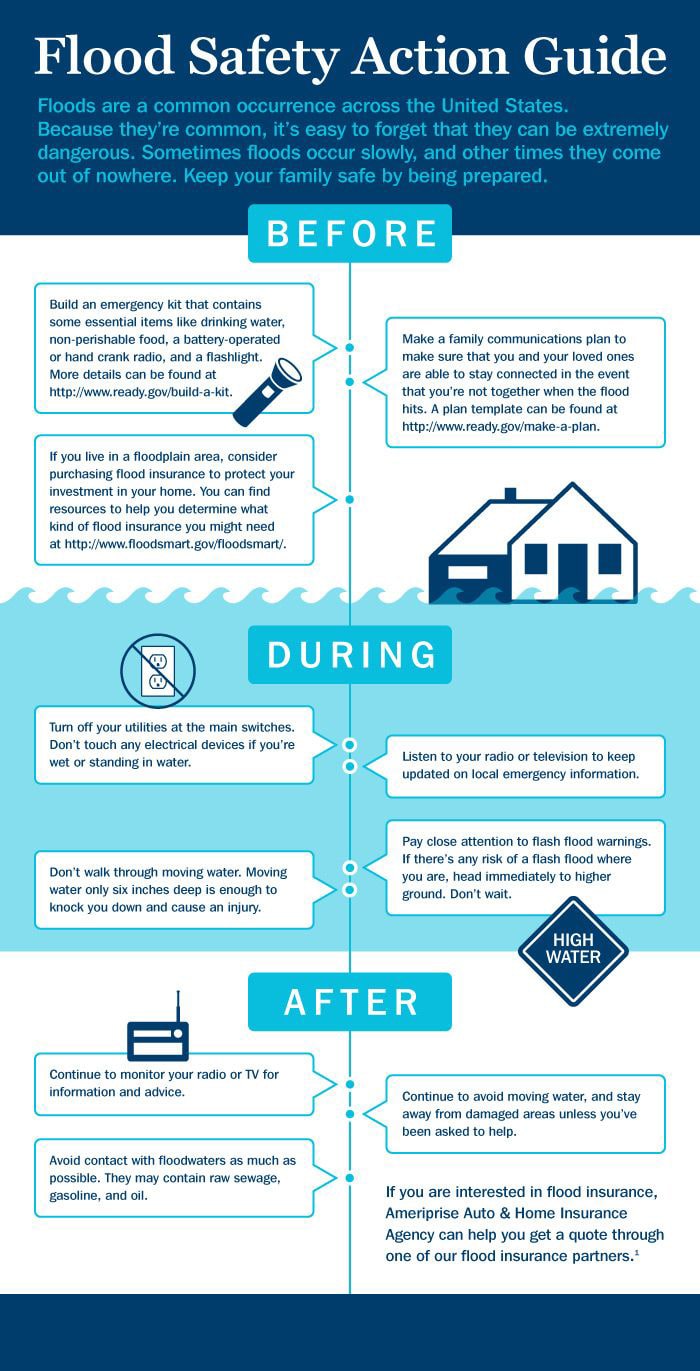

It is important to take note of the things you need to do after a flood damage, including:

- Take pictures

- Protect and be aware of your health

- Inform your insurance company

- Find out if you’re in a disaster area

- Remove as much water as you can

- Reduce mold damage

- Secure the property

How To Prevent Flood Damages?

Although it may not happen often, it is always better to regularly check on home maintenance to prevent any damages that may happen in the future. Nobody likes flood damage so here are some ways to prevent flooding from happening:

- Always look at your hoses that are attached to washing machines, dishwashers, refrigerator, heaters and replace them every five years or as needed.

- Be careful not to break the water hose or pull it with force when moving any appliances

- Drain the water from heaters every 6 months to prevent buildup of different types of sediments

- Maintain the heat in your home and prevent the pipes from freezing.

- Always inspect the water valve and replace it if its needed.

Statistical Information On Flood Damages

- The average flood claim is estimated to $42,000 and flood insurance claims are estimated to more than $3.5 billion per year and this is just from 2005- 2014.

- There are about 5.3 million flood policies across 22,000 communities in the United States.

How We Resolve Your Concern

You may be concerned with what steps to take next. You may have filed a claim with your insurance company about the flood damage your property suffered, but it was denied. No matter what the reason is, we will provide you with a skilled set of public adjusters. We work with you. Along with achieving maximum monetary recompense, we empathize with your loss. We understand that it is a current hardship placed in your life, and we want to relieve some of that tension. If you have been a property owner who has encountered a flood damage, don’t delay in contacting us. We know how to negotiate with insurance companies that would not give you the reimbursement that you need.

References