Insurance Coverage On Residential Claims

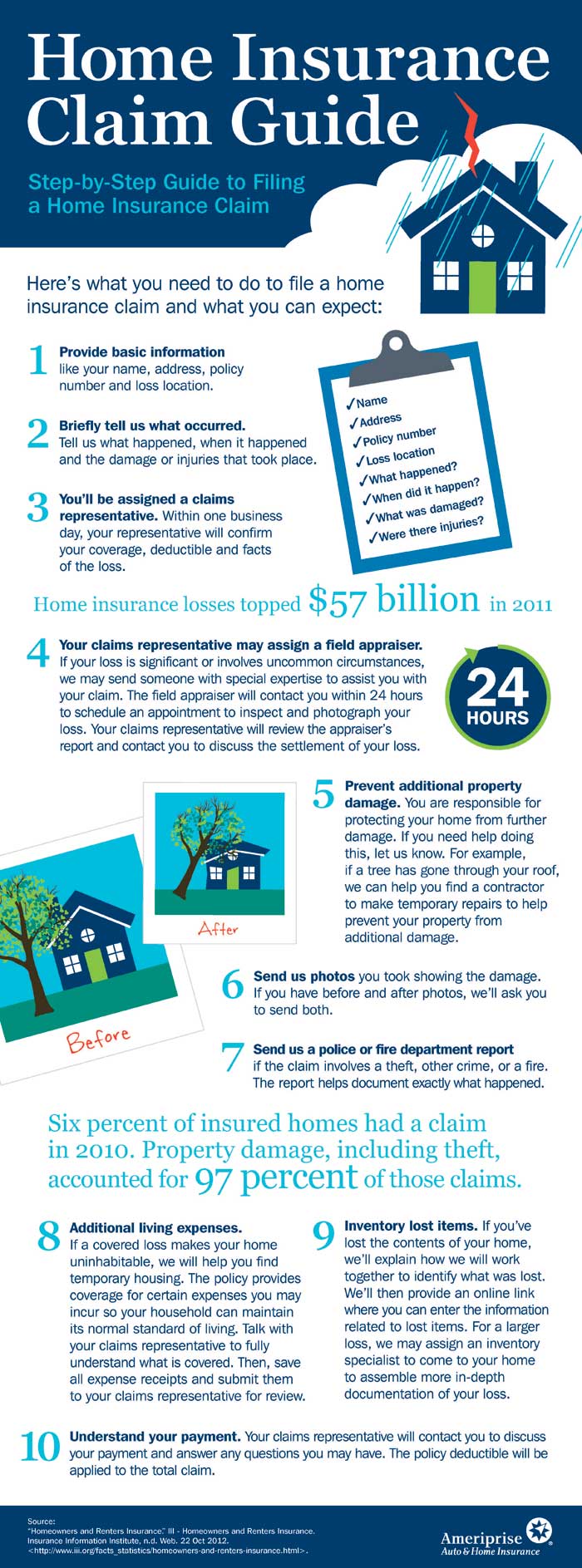

The standard coverage for residential claims offers ordinance coverage and additional living expenses. Ordinance coverage means that your insurance company will give you coverage for any damage that has been done to the building. You also have the option of buying a replacement coverage. Additional living expenses on the other hand, cover the costs of the temporary location you will be living at during the time of the repairs. This includes rent, hotel, food, and other expenses that you have paid for.

Damages that May Be Covered Under Your Policy

Residential Claim for Homeowners Insurance Public Adjusters by Serafin Martinez on Scribd

Everyone decides on what type of insurance coverage they decide to buy. Depending on which policy you hold, then certain damages are covered under that policy. Here are some things that may be covered under your policy:

Living expenses: If your property has mold or if repairs are ongoing, you may have to relocate. Please ensure to keep all receipts for any expenses that you made due to the relocation such as: hotels, storage, etc.

Personal property: Make a list and photograph everything that was damaged. This may include appliances, sporting equipment, tools, clothing, etc.

Water Damage: Flooding is typically only covered under a flood policy. However, water damage from a burst pipe or water entering the home via caused by sudden damage to the roof would be covered.

These are the major categories that are covered under a residential insurance policy. Make sure you understand what your policy covers.

Process to File Residential Claims:

The first thing to always do when you’re filing residential claims is to first look at your coverage. You need to read and understand this because some of the damage that you are claiming may not be covered under your policy. But if it is, here are some steps you may need to take:

- Contact your insurance company. It is important to get in touch with your insurance company to understand what is covered under your insurance policy. You may have additional questions such as “how long do I have to file a claim?” or “how long will the process take?” etc.

- Make sure that your insurance company adjuster inspects the damage. Insurance providers will send a claims adjuster to inspect the damage to your home. You need to hire your own public adjuster that will look out for your interests as the insurance company’s claims adjuster is looking out for theirs.

- Mitigate the damages. Take pictures or videos of the damages that were made to your home and take further steps in protecting it from more damages. Avoid throwing out items that were damaged and save receipts for all the items you bought that have protected your home, you can get reimbursed for this.

- Make a list of things or items that were damaged or lost. This list would be given to the public adjuster to evaluate and for estimating the cost of the damage.

- Keep your receipts for everything. Especially if your home has been severely damaged and are relocating temporarily. Most insurance policies will cover the added expenses for lodging.

- Ask questions always. Don’t be shy to ask your insurance provider questions. It is their job to give you all the details and information you might need about your policy or even your claims.

- Report all criminal activity to the authorities. This is essential if your home has been broken into, vandalized or burglarized.Immediately contact the police and obtain the names and contact information of the officers.

Insurance Payment Process

The initial payment that is given to you by your insurance is not the final payment, it is sometimes an advance. If you are offered a full and final payment then you should hesitate on accepting the offer. If you are accepting a final payment, be sure to be aware of what it entails because you do have to sign a general release in which you waive many of your rights. If more damage is done later, you still have the option to reopen the claim and request for additional reimbursements, but you need to fully provide the damage that was done, where and when. Insurance companies typically want all the documents for it.

If your home and personal belongings are part of the damage, you will get two reimbursement checks from your insurance company. The check that is specifically for your home will be given to you and your mortgage lender, only if your house is mortgaged. As for your personal belongings, it is recommended that you need to replace the items that were damaged before your insurance company can reimburse you. If you don’t replace those items, your insurer will give you the actual cash value.

Here on Your Behalf

We know how to deal with insurance companies because they always have a great deal of complexity. It is important to understand the hierarchy at the insurance company to obtain the best results for our clients. There have been various well-chronicled news reports that indicate that some major insurance companies do not pay the full extent of damages reported. It is our mission to try to recover the full amount of damages and help you on the road to rebuilding your home. To receive everything that you need to rebuild your home from its damages, call us today! We have many years of experience and have learned the best ways to negotiate with insurance companies. Don’t go through this process alone. Take our hand!

Statistical information

- There have been about 97.3% of claims that are property damage related in 2014 alone.

- From 2011-2015, the highest claim values were fire and lighting damage

- Wind and hail are the most frequent claims made by homeowners

- 1 in 15 homes that have insurance file a claim each year

- 1 in 35 homes have annual property damage claims

- 1 in 50 claims are caused by water damage or freezing

- 1 in 235 have theft claims

- 1 in 290 have fire and lighting damage

References: